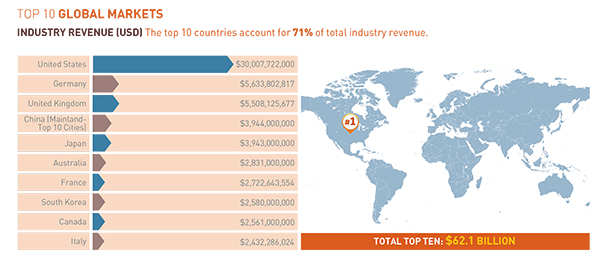

Last year, health club membership topped 174 million consumers around the globe. Industry revenue totalled an estimated AU$118.8 billion in 2017 and the club count exceeded 200,000 facilities.

As leading markets posted strong performance, emerging markets — particularly in the Asia-Pacific region — showed potential for continued growth, according to The 2018 IHRSA Global Report, which was published in May.

The Americas

Revenue, membership, and the total number of clubs all increased in the U.S. from 2016 to 2017. Revenue grew from $27.6 billion in 2016 to $30 billion in 2017, while membership increased from 57.2 million to 60.9 million. The U.S. club count rose from 36,540 locations to 38,477 sites.

The IHRSA Canadian Health Club Report indicates that club operators serve nearly 6 million members at roughly 6,000 facilities in Canada. IBISWorld, an independent industry research firm, projects that revenue from gyms and health clubs in Canada will increase through 2019.

One of the key drivers for growth is consumer demand for health and fitness programs to help address obesity, active aging, proper nutrition, and sports performance.

The Latin American health club market is robust with potential for growth. Based on data gathered in The IHRSA Latin American Report (Second Edition), Brazil’s 34,000 health clubs rank the country second only to the U.S. among global fitness markets. More than nine million Brazilians are members of a health club. With more than 12,000 health club facilities, Mexico ranks second in Latin America and third worldwide in terms of number of clubs.

Opportunities for growth exist in Latin America as member penetration rates remain low at an average of 2.15% across 18 countries.

Europe

Europe

Roughly 60 million Europeans belong to a health club or studio, as the industry generated an estimated $28.8 billion in revenue at 59,000 facilities last year. The UK and Germany continue to lead all markets in Europe.

In the UK, based on research by the Leisure Database Company, 9.7 million members belong to one of the nation’s 6,728 health clubs and studios. Germany attracts more than 10 million members at nearly 9,000 locations and generates $5.6 billion in annual revenue.

According to the European Health & Fitness Market Report, Europe has strong prospects for growth considering not only the mature, solid markets in Western Europe, but also the potential in Eastern European markets such as Russia, Turkey and Poland. While the average penetration rate in Europe is 10.3%, Russia and Turkey have the lowest penetration rates at 2.4% and 2%, respectively.

Middle East & North Africa

Based on findings gathered by The FACTS Academy (industry experts based in Egypt), approximately 3.4 million members utilise 5,600 health clubs in 10 markets in the Middle East and North Africa. These 10 markets collectively generate roughly $2 billion in revenue. Saudi Arabia leads all markets in this region in revenue with nearly $620 million generated at 1,100 health clubs, which attract more than 800,000 members. In terms of club count and memberships, Egypt leads all MENA markets with 1,680 facilities and 957,500 members.

Despite conflicts in several MENA countries, there is a demand for fitness as consumers seek to exercise and reap the benefits of an active lifestyle.

Successful international fitness operators—including Fitness First, Gold’s Gym, and World’s Gym—have expanded into the Middle East. In less than 10 years, Fitness Time, based in Saudi Arabia, grew to 100 club locations, highlighting the opportunity in this region.

Asia-Pacific

The Asia-Pacific region serves 22 million members at more than 25,000 clubs. In total, this market generates annual revenues of $16.8 billion (USD), excluding the Middle East, according to The IHRSA Asia-Pacific Health Club Report.

Fuelled by growing economies, the health club industry in the Asia-Pacific is robust, with significant potential for continued growth.

Only two markets in the region are considered mature: Australia and New Zealand, which have the highest penetration rates at 15.3% and 13.6%, respectively.

While the fitness market shows signs of rapid growth and professionalisation in Hong Kong (5.85%), Singapore (5.8%) and Japan (3.3%), opportunities for growth remain in the Philippines (0.53%), Thailand (0.5%), Indonesia (0.18%) and India (0.15%).

Driven by the momentum of economic growth, the fitness market in the Asia-Pacific region has shown steady growth with a positive outlook going forward.

Overall market penetration is on an upward trajectory, reflecting an increasing awareness of health club memberships.

However, the region’s fitness market remains stratified due to varying stages of development, which can be categorised into three tiers:

- Tier 1: Australia (15.3%) and New Zealand (13.6%) are relatively established markets, with higher penetration rates than their neighbours. However, the mature and professionalized markets in these countries indicate limited growth potential; labor and real estate costs have also constrained growth here.

- Tier 2: Hong Kong (5.85%), Singapore (5.8%), Japan (3.3%) and Taiwan (3.0%) belong to the fast-expanding and maturing second-tier markets. This segment features gradually professionalizing services, expanding consumer bases, and high concentration of leading players. With room for growth, already fierce competition is expected to continue in the future.

- Tier 3: The remaining Asia-Pacific markets are still in a comparatively early stage, as a result of slower economic development and low awareness of personal health. Malaysia (1.04%), China’s top 10 cities (0.97%), Philippines (0.53%), Thailand (0.5%), Vietnam (0.5%), Indonesia (0.18%) and India (0.15%) comprise the emerging markets. The fitness industry in these countries is typically concentrated in the capital and first-tier cities, where markets are mainly led by commercial fitness club chains.

The markets in second-tier (and under) cities, however, are dominated by standalone players that are mostly lower-end “mom-and-pop” shops, due to infrastructure underdevelopment, low purchasing power, and low awareness of personalised training. Underdeveloped regions in these countries demonstrate high growth potential as rapid infrastructure development improves accessibility and connectivity.

Conclusion

The outlook of the health club industry is bright and promising. As leading economies continue to improve, the industry is expected to thrive in the global marketplace, serving consumers with a variety of health and fitness needs. Offering access to fitness amenities, instructors, trainers and coaches, club operators are well positioned to lead a healthier world.

Visit ihrsa.org/research-reports to access any of the IHRSA publications cited in this article.

Article written by Melissa Rodriguez for the What’s New in Fitness Magazine – Spring 2018 Edition.